Tavenraro v. Pioneer Credit Recovery

In the recent case of Tavernaro v. Pioneer Credit Recovery, Inc. 43 F 4th 1062 (Aug. 8, 2022), the Tenth Circuit clarified what kind of statements are actionable under the FDCPA. The court held that representations violated the FDCPA only if they are materially false, deceptive or misleading to a reasonable consumer.

In the recent case of Tavernaro v. Pioneer Credit Recovery, Inc. 43 F 4th 1062 (Aug. 8, 2022), the Tenth Circuit clarified what kind of statements are actionable under the FDCPA. The court held that representations violated the FDCPA only if they are materially false, deceptive or misleading to a reasonable consumer.

The court said that the FDCPA does not make actionable every false representation; instead to be actionable, statement(s) must be material, which is to say capable of influencing the consumer’s decision-making process. The court was persuaded by the FTC’s practice of evaluating the “overall net impression” of a representation instead of an “isolated word or phrase.”

Significantly, the court rejected the unsophisticated and least sophisticated consumer standards that are so prevalent around the country. Referring to such standards as vague and difficult to apply, the court adopted the “reasonable consumer standard.”

Applying this standard the court the court took this approach: 1) is the statement misleading; 2) if yes, then could the reasonable consumer, after assessing the statement as a whole and in context reasonably interpret the statement to have two meanings, one of which is untrue and 3) if the reasonable consumer could understand the representation to be misleading, materiality is then assessed by asking whether the reasonable consumer would have his ability to intelligently respond frustrated.

In Tavernaro, Mr. Tavernaro sued Pioneer Recovery because Pioneer Recovery placed the logo of the original creditor on the first page of the dunning letter instead of Pioneer Recovery’s own logo. Mr. Tavernaro complained that such placement was misleading. The court disagreed. The court said that, taken as a whole, Mr. Tavernaro, as a reasonable consumer, would know who owns the debt, who was contracted to collect the debt (Pioneer Recovery) and where to remit payments (Pioneer’s mailing address). Thus the letter was not materially misleading and did not violate the FDCPA.

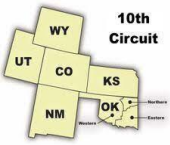

This case provides some common sense relief for those debt collectors who are operating in the Tenth Circuit.